401k Contributions 2025 Limits. The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions. 401k and retirement plan limits for the tax year 2025.

The 401 (k) contribution limit for 2025 is $23,000. 2025 limits on 401k contributions for age 50 images references :

401k 2025 Contribution Limit Chart, The 401(k) contribution limit is $23,000. For those with a 401(k), 403(b), or 457 plan through an employer, your new maximum contribution limit.

Simple Ira Contribution Limits 2025 Irs Elisha Chelsea, As of 2025, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a. In 2025, employees can contribute up to $23,000 to their plans.

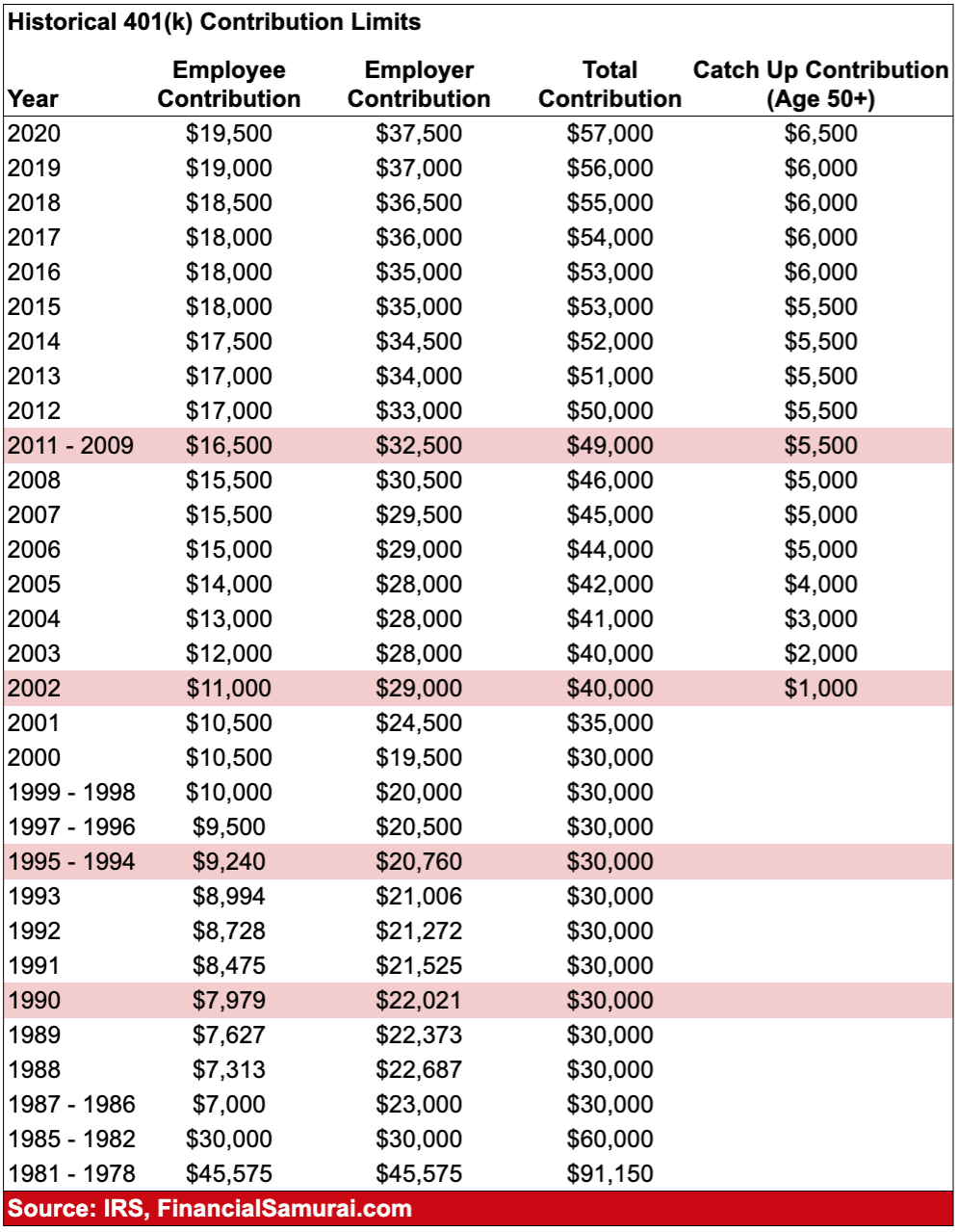

Irs 2025 Max 401k Contribution Limits Ruthy Peggie, The below table lists the maximum 401k plan contribution limits over the years. The 401 (k) contribution limits for 2025 are $23,000 for people under 50, and $30,500 for those 50 and older.

2025 Inheritance Limit Flss Orsola, Starting in 2025, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs. For 2025, the irs limits the amount of compensation eligible for 401 (k) contributions to $345,000.

Irs Limits 401k 2025 Rene Vallie, On november 1, 2025, the internal revenue service announced that the amount individuals can contribute to their 401(k). In 2025, individuals under age 50 can contribute up to $23,000 to traditional and roth 401(k) plans.

Irs Limits 401k 2025 Rene Vallie, Here's how the 401(k) plan limits will change in 2025: Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025.

401k Contribution Limits 2025 Roth Paula Cariotta, See the limits for traditional 401(k)s, roth 401(k)s, employer contributions, and profit sharing. On november 1, 2025, the internal revenue service announced that the amount individuals can contribute to their 401(k).

5 formas de aumentar sus ahorros en 2025, For 2025, the irs limits the amount of compensation eligible for 401 (k) contributions to $345,000. The 401 (k) contribution limits for 2025 are $23,000 for people under 50, and $30,500 for those 50 and older.

401k Contribution Limits 2025 Over 50 Years Becka Carmita, 2025 401k catch up contribution limits 2025. In 2025, people under age 50 can contribute $23,000.

What Is The Maximum Amount Of 401k Contribution For 2025 Emili Janessa, What is the 401(k) contribution limit in 2025? 2025 limits on 401k contributions for age 50 images references :

401k catch up contribution limit 2025 ailis arluene, total 401 (k) plan contributions by an employee and an employer cannot.